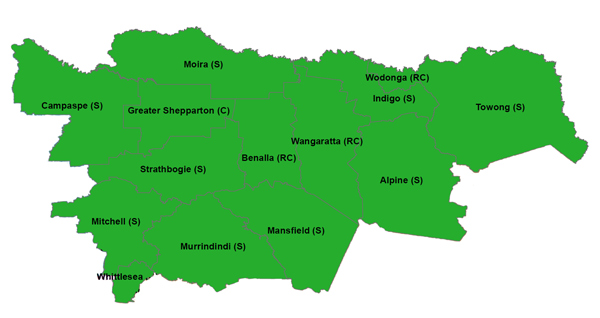

Regional Round-up is a monthly newsletter providing an overview into the environmental and business conditions affecting farmers and rural businesses in the Goulburn Valley and North East Victoria.

Appalling weather conditions dominated the NE region throughout January with a number of major fires affecting large areas of the Towong, Alpine, Wangaratta and Mansfield LGAs. A considerable area of both public and private land has been burnt resulting in an unquantifiable cost across all sectors of the regional economy.

There has also been extensive indirect damage from the fires on the regions wine industry due to smoke taint. The most recent estimates are that possibly 90% of the grapes in the North East wine regions will not be harvested this year.

Near Myrtleford approximately 2,400 ha of pine plantations were burnt.

The full impact on small business due to a dramatic decline in tourists is difficult to quantify.

The stress on all families dealing with 3 weeks of smoke pollution and the uncertainty of potentially getting burnt has been telling.

Water quality in some burnt areas is also an issue.

The rain which followed up caused large areas of top soil lost and black water.

Dairy

Forty dairy farmers in region effected by bushfire had to dump milk over a 48 hour period due to road closures. Both major milk processors in the region agreed to pay to for all dumped milk.The Water for Fodder program was extremely popular, but unfortunately saw only 1 in 5 applications being successful.

The good milk price being offered by processors has helped many farmers be more optimistic about the future, especially if they own their own water. The Temporary Water price and therefore money spent on purchased fodder, are still the main drivers of industry pain.

Dairy farmers continue to exit the industry, with an RFC reporting that a local smart and successful young farmer selling the dairy herd but remaining on land.

RFCs are reporting that banks are reducing their lending whilst the drought continues. There are also some dairy farmers out there evaluating options of expanding their businesses and/or being proactive and not looking to exit. Some clients have included seeking information to support new share-farming contract, assessing merits of buying another farm and/or out-block, succession planning, and referral for guidance on financial planning to minimise tax implications and how best to fund their retirement. This has shown that there are dairy businesses out there still viable, and optimistic about the future. The common denominator with these farms is that they tend to have lower debt levels and/or own significant amounts of water.

High feed prices, high water prices and cash flow remain issues for dairy farming clients.

Dairy herds continue to be reduced.

Farmers struggle with temperatures in 40’s putting pressure on feed stocks as they try to maintain production. There has been reports of some herds’ milk production dropping due to fodder availability and climatic conditions.

RFCs continue to identify exhausted dairy farmers currently operating temporary mixed ration systems in lieu of pasture based systems.

Cropping

Harvest yields were slightly below average, however elevated grain/hay prices have meant that gross margins have been strong.Croppers are now focusing on what they will sow given recent rains and likely prices.

Hay sales have reportedly quietened during past couple of weeks. This is believed to be due to considerable rainfall in northern NSW and QLD.

Cropping contractors are concerned about the lack of forward planning by farming clients, finance for crops and available soil moisture are all posing concern

With some reasonable rainfall this month farmers will have to start spraying for summer weeds. A local Goulburn Valley agronomist suggested this summer is the quietest season he can recall due to the absence irrigated summer crop activity.

Sheep

Sheep prices still looking good.The very hot and dry summer has put pressure on stock water, with many dry dams.

Areas that had good spring growth (foothills and valleys) have led on to a very good source of dry feed for livestock. This dry pasture has been a great benefit to many areas and has reduced pressure on supplementary feeding.

Beef

Large numbers of beef cattle and sheep have been moved to agist out from the Upper Murray, with a number also having to be slaughtered. It is believed that hay will run short in the Upper Murray in the near future.Rainfall will bring new life back to pasture still in rotation, however it may do more harm than good due to weed strike.

Hill areas with high stocking rates are noticeably bare and is prone to erosion during recent heavy rainfall events.

Graziers continue to receive good prices at market for sales in January.

Irrigation

The Goulburn system continues to track at average to dry and the estimated allocation is 70%. The Weighted Average Price for allocation water traded in the Goulburn for the month of December was $590 and for January was $675. High prices have seen a decline in demand with water traded in January, almost half (27,687 MegL) against the same period in the previous season.Rainfall in January provided a much needed morale boost to farmers in the GMID and saved pasture watering, but will also grow weeds.

Irrigators want clearer information about the future plan for water to have business confidence.