With ongoing drought and dry conditions in parts of Victoria, and evidence of increased economic and well-being impacts, Agriculture Minister Jaclyn Symes has announced an additional $12.6 million package of targeted support to impacted farm businesses.

The package includes:

Continuation of the

On-Farm Drought Infrastructure Support Grants Program

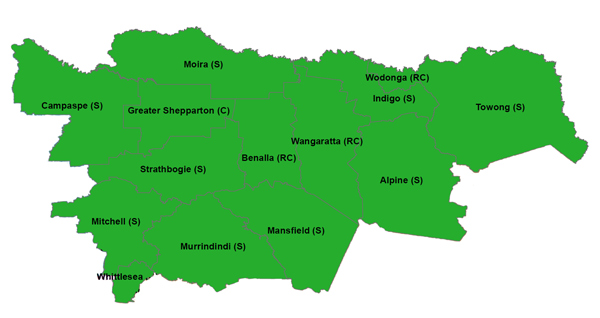

Grants of up to $5,000 are available to eligible farm businesses in Central and East Gippsland and Northern and North West Victoria. The farm business is required to match the grant value with a dollar for dollar co-contribution.

- Grants are for infrastructure only – farm labour cannot be claimed

- Quotes must be obtained for proposed infrastructure

- Infrastructure works cannot commence prior to grant approval.

New Programs:

Farm Business Assistance Program providing targeted support in Central and East Gippsland and for eligible dairy farmers in northern Victoria

- Farm Household Allowance (FHA) recipients and young farmers in Central and East Gippsland will receive $3,500

- Remaining commercial farms in Central and East Gippsland will receive $2,500

- For northern Victoria, $2,500 will be made available to dairy farmers that are FHA recipients and/or young farmers.

Establishment of a Farm Support Fund

The program will provide immediate financial relief and alleviate some cost-of-living pressures for specific farm businesses not eligible for the Farm Business Assistance program. This will be determined on a case-by-case basis to the value of $2,500. Available for farmers in Northern Victoria and North West Victoria that are experiencing financial pressure and are not eligible for the Farm Business Assistance program.

Improving access to emergency water supply points

AgVic - further information